| Answers questions about the Trust's Legal Claims and Request for Mediation 12:50 - Sep 15 with 6272 views | Darran |

Q: What has happened so far?

A: Following the majority owner, at the end of last year, breaking off negotiations to buy part of the Trust’s shareholding in the company which owns the Club (which we’ll call ‘2002 Limited’ for short), the Trust Board instructed lawyers to review the factual background, from the formation of the Trust to 2016 and beyond, and to consider the Trust’s legal position with regard to the 2016 sale and its aftermath.

This resulted in a detailed chronology being prepared and a Claim Letter being sent on behalf of the Trust to the majority owner, Huw Jenkins and others on 18 May 2018, setting out the Trust’s legal claims. This was in order to comply with a standard Direction from the High Court as to what claimants must do before they commence court proceedings. That includes trying to resolve claims with intended defendants at an early stage by negotiation, mediation or other methods that avoid court proceedings.

The Trust’s lawyers therefore proposed mediation, but that was rejected by the majority owner. In spite of that proposal being repeated with further explanation, no further response to it has been received.

According to the Court Direction, intended defendants who receive a Claim Letter must respond to it within a reasonable time and no later than 3 months in a very complex case. The majority owner, through its lawyers, stated that it would provide a reply letter within that 3 month period, but did not do so and shows no sign of doing so. It is clear, therefore, that the majority owner is in breach of the Court Direction.

The other intended defendants, including Huw Jenkins, have also failed to comply with the Court Direction in not providing a response letter within the required period.

Recently, the majority owner has suggested a confidential meeting with the Trust and that possibility is being discussed between the respective lawyers. No indication has been received of what the majority owner wishes to discuss. It is not clear whether it is intended that Huw Jenkins and others should also take part.

A confidential meeting took place many weeks ago between members of the Trust Board, Huw Jenkins and Martin Morgan. Since then, the lawyer acting for them and some other former shareholders has approached the Trust’s lawyers, more than once, to propose a further meeting, but when our lawyers responded with suggested dates, no reply was received.

Q: Against whom are the Trust’s claims made?

A: The Claim Letter was sent to:

the majority owner (Swansea Football, LLC)

other listed shareholders, namely:

OTH 2015 Limited

Martin Morgan

Louisa Morgan

David Morgan

Huw Jenkins

Bulk Vending Systems Limited

Brian Katzen

Jason Levien

Steve Kaplan

Leigh Dineen

2002 Limited (as required by law).

Q: What is the Trust claiming?

A: There are several legal claims, including:

That since the sale of a controlling interest to the majority owner, the affairs of 2002 Limited have been conducted in a manner that is unfairly prejudicial to the interests of the Trust as a shareholder. For example, the Trust was excluded from the share sale and from a new Shareholders’ Agreement between the majority owner and the other remaining shareholders as to how the company is to be managed. If it reached Court and the Court agreed with the Trust, it could (amongst other options) order the majority to purchase all or part of the Trust’s shares for a reasonable price (which the Trust would argue is that which Huw Jenkins and others received).

That the 2002 Shareholders Agreement, which had been operated for many years and accepted as valid and binding, was breached by virtue of the Trust not being given first refusal to purchase any of the shares sold in 2016, by new Articles of Association being adopted without the Trust’s consent and by non-observance of an implied duty of ‘good faith’ between shareholders (e.g. the other shareholders excluded the Trust from knowledge of and participation in negotiations with Jason Levien and Steve Kalpan for the sale of shares to the present majority owner).

That Huw Jenkins and others made misstatements which caused the Trust loss, for which the Trust is entitled to damages, namely that the Trust did not wish to sell any shares and that there was no existing Shareholders Agreement of binding effect.

Although those in receipt of the Claim Letter have not provided the required response letters, it is understood that they deny the claims.

Q: What is mediation? What is the effect of the majority owner refusing it?

A: Mediation is a type of voluntary negotiation in which an independent mediator tries to assist parties to reach an agreement to resolve their disputes. The mediator does not make a decision as to who is right or wrong and cannot force the parties to enter into an agreement. Mediation has a high success rate.

As mediation is voluntary, the majority owner cannot be forced to mediate. However, the Court may punish an unreasonable refusal to mediate, if the stage of court proceedings is reached, by imposing costs sanctions. The Trust considers that the refusal of the majority to mediate is unreasonable and that the failure of Huw Jenkins and others to respond to the proposal is also unreasonable.

Q: What happens next?

A: Due to the refusal of the majority owner to produce a copy of the 2016 Share Sale and Purchase Agreement, as well as some other relevant documents, the Trust has instructed its lawyers to make an application to the High Court for an order for ‘pre-action disclosure’. That is likely to be issued within the next 10 days.

The Trust Board remains willing to mediate or negotiate in good faith, but there has been much delay by the intended defendants and the Trust’s claims cannot remain unresolved for much longer. The Trust’s Board and lawyers are making plans for litigation, should it become necessary, and there will be a full consultation of the members before any decision is taken.

|  |

| |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 13:39 - Sep 16 with 1748 views | 34dfgdf54 |

Definitely.

Edit - was meant to quote Nookie’s original post about Huw and Dineen’s roles being written into contract when selling shares. [Post edited 16 Sep 2018 13:40]

|  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 18:46 - Sep 16 with 1620 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:41 - Sep 16 by Nookiejack |

Isn’t it the case that a group of shareholders worked together to achieve considerable successs over 13-14 year period , with no one shareholder allegedly being allowed to have more than 25% stake. Howevee that relationship broke down and all shareholders except the Trust - changed the articles just before the Sale - to leave any minority shareholder in a totally illiquid position in respect of future sale of their shares. Those shares then being totally worthless under the new Articles.

But then all the other shareholders sell their shares - without the Trust being told/excluded from the sale process - so it was only the Trust left if an illiquid position.

So o can understand the ‘several’ point being made.

It seems clear to me that this has been totally unfairly prejudicial to the Trust. |

Unfair Prejudice has a clearly defined meaning in law, specifically that a loss has been suffered. Being treated like shit isn't in itself actionable under this statute.

So the right of first refusal was not offered to the Trust. But the Trust had no money to exercise that right at the price paid by Kaplan. Had the right of first refusal been offered it would have made no difference to the Trust's shareholding. Monetary loss = nil.

Similarly the Trust were not shown the new articles of association prior to their adoption. Had they been advised of them prior to their adoption they still wouldn't have have been able to do anything about it, because the sellers had just under 80% of the votes, more than ample for approval under the Companies Act.

Furthermore, the opportunity to lobby the other shareholders would almost certainly have been useless, because they were resolved to sell to Kaplan, and had quite likely signed some sort of binding pre-contract already. So the monetary loss suffered is again nil.

Regardless the shareholders agreement would almost certainly have said something about the process for changing the company statutes.

But at the same time the SHAG should also have made some mention of provisions and the process for terminating the agreement itself. If it didn't that would be a serious deficiency, because there must always be some way of terminating agreements, even if they don't say so specifically. And the 78.9% of the votes the sellers could muster collectively is enough to do anything in Company Law.

So the net effect of having done everything strictly by the book would merely have been to delay events by a few weeks. And the only real loss the Trust suffered was by being excluded them the sale process itself. Which is actionable as Unfair Prejudice. [Post edited 16 Sep 2018 18:51]

|  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 19:15 - Sep 16 with 1562 views | longlostjack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 18:46 - Sep 16 by Shaky |

Unfair Prejudice has a clearly defined meaning in law, specifically that a loss has been suffered. Being treated like shit isn't in itself actionable under this statute.

So the right of first refusal was not offered to the Trust. But the Trust had no money to exercise that right at the price paid by Kaplan. Had the right of first refusal been offered it would have made no difference to the Trust's shareholding. Monetary loss = nil.

Similarly the Trust were not shown the new articles of association prior to their adoption. Had they been advised of them prior to their adoption they still wouldn't have have been able to do anything about it, because the sellers had just under 80% of the votes, more than ample for approval under the Companies Act.

Furthermore, the opportunity to lobby the other shareholders would almost certainly have been useless, because they were resolved to sell to Kaplan, and had quite likely signed some sort of binding pre-contract already. So the monetary loss suffered is again nil.

Regardless the shareholders agreement would almost certainly have said something about the process for changing the company statutes.

But at the same time the SHAG should also have made some mention of provisions and the process for terminating the agreement itself. If it didn't that would be a serious deficiency, because there must always be some way of terminating agreements, even if they don't say so specifically. And the 78.9% of the votes the sellers could muster collectively is enough to do anything in Company Law.

So the net effect of having done everything strictly by the book would merely have been to delay events by a few weeks. And the only real loss the Trust suffered was by being excluded them the sale process itself. Which is actionable as Unfair Prejudice. [Post edited 16 Sep 2018 18:51]

|

I’m no lawyer Shaky but the fact that the Trust has been unfairly prejudiced seems to be clear. I always thought that equity was the highest principle of the law in England and Wales. How they work out the remedy I don’t know. On a polemic note - the Trust are not country bumpkins. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 19:55 - Sep 16 with 1509 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 19:15 - Sep 16 by longlostjack |

I’m no lawyer Shaky but the fact that the Trust has been unfairly prejudiced seems to be clear. I always thought that equity was the highest principle of the law in England and Wales. How they work out the remedy I don’t know. On a polemic note - the Trust are not country bumpkins. |

Well the legal unfair prejudice case certainly "was not clear" to the first expert the Trust hired to look at this.

http://www.swanstrust.co.uk/2016/10/20/trust-members-forum-address/

Happily these days every man and his dog is now an expert in Unfair Prejudice actions. Or not as the case may be. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 20:56 - Sep 16 with 1437 views | Darran |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 19:55 - Sep 16 by Shaky |

Well the legal unfair prejudice case certainly "was not clear" to the first expert the Trust hired to look at this.

http://www.swanstrust.co.uk/2016/10/20/trust-members-forum-address/

Happily these days every man and his dog is now an expert in Unfair Prejudice actions. Or not as the case may be. |

“Happily these days every man and his dog is now an expert in Unfair Prejudice actions. Or not as the case may be”

|  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 22:57 - Sep 16 with 1349 views | Nookiejack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 18:46 - Sep 16 by Shaky |

Unfair Prejudice has a clearly defined meaning in law, specifically that a loss has been suffered. Being treated like shit isn't in itself actionable under this statute.

So the right of first refusal was not offered to the Trust. But the Trust had no money to exercise that right at the price paid by Kaplan. Had the right of first refusal been offered it would have made no difference to the Trust's shareholding. Monetary loss = nil.

Similarly the Trust were not shown the new articles of association prior to their adoption. Had they been advised of them prior to their adoption they still wouldn't have have been able to do anything about it, because the sellers had just under 80% of the votes, more than ample for approval under the Companies Act.

Furthermore, the opportunity to lobby the other shareholders would almost certainly have been useless, because they were resolved to sell to Kaplan, and had quite likely signed some sort of binding pre-contract already. So the monetary loss suffered is again nil.

Regardless the shareholders agreement would almost certainly have said something about the process for changing the company statutes.

But at the same time the SHAG should also have made some mention of provisions and the process for terminating the agreement itself. If it didn't that would be a serious deficiency, because there must always be some way of terminating agreements, even if they don't say so specifically. And the 78.9% of the votes the sellers could muster collectively is enough to do anything in Company Law.

So the net effect of having done everything strictly by the book would merely have been to delay events by a few weeks. And the only real loss the Trust suffered was by being excluded them the sale process itself. Which is actionable as Unfair Prejudice. [Post edited 16 Sep 2018 18:51]

|

Shareholders with 80% of the votes (the selling shareholders) can’t change the articles to result in one shareholder then not being able to sell their shares in future.

Those shares then being totally illiquid and worth Nil.

That is a monetary loss of circa £21m.

Please read the new articles to understand how the Trust has been unfairly prejudiced.

The Majority shareholder, who is in control of the shares, can sell its shares to a new buyer without including anyone else. Then in future the new majority shareholder can do the same and so on. Control can be passed on without ever including minority shareholders- hence Trust’s shares are totally illiquid and worthless.

To repeat you had a group of shareholders working together for 13-14 years to achieve considerable success - then shareholders with as you say 79% of votes gang up on another shareholder, the Trust, to leave that shareholder in a totally illiquid position.

Those 79% shareholders would have also received the benefit that the Yanks paid for taking control of the club ie the control premium.

A judge will look at the full factbase and in my view the Trust has a very high chance of success. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 23:06 - Sep 16 with 1329 views | QJumpingJack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 22:57 - Sep 16 by Nookiejack |

Shareholders with 80% of the votes (the selling shareholders) can’t change the articles to result in one shareholder then not being able to sell their shares in future.

Those shares then being totally illiquid and worth Nil.

That is a monetary loss of circa £21m.

Please read the new articles to understand how the Trust has been unfairly prejudiced.

The Majority shareholder, who is in control of the shares, can sell its shares to a new buyer without including anyone else. Then in future the new majority shareholder can do the same and so on. Control can be passed on without ever including minority shareholders- hence Trust’s shares are totally illiquid and worthless.

To repeat you had a group of shareholders working together for 13-14 years to achieve considerable success - then shareholders with as you say 79% of votes gang up on another shareholder, the Trust, to leave that shareholder in a totally illiquid position.

Those 79% shareholders would have also received the benefit that the Yanks paid for taking control of the club ie the control premium.

A judge will look at the full factbase and in my view the Trust has a very high chance of success. |

The Trust will win in court as Levien has admitted at a fans forum (April 2017) that they were asked to keep the Trust out of the talks. It is on record. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 23:51 - Sep 16 with 1295 views | Darran |

A statement from me.

I’ve had a dreadful row from people for sharing the info in the OP and I’m so so sorry. |  |

|  |

Login to get fewer ads

| Answers questions about the Trust's Legal Claims and Request for Mediation on 23:57 - Sep 16 with 1289 views | Nookiejack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 18:46 - Sep 16 by Shaky |

Unfair Prejudice has a clearly defined meaning in law, specifically that a loss has been suffered. Being treated like shit isn't in itself actionable under this statute.

So the right of first refusal was not offered to the Trust. But the Trust had no money to exercise that right at the price paid by Kaplan. Had the right of first refusal been offered it would have made no difference to the Trust's shareholding. Monetary loss = nil.

Similarly the Trust were not shown the new articles of association prior to their adoption. Had they been advised of them prior to their adoption they still wouldn't have have been able to do anything about it, because the sellers had just under 80% of the votes, more than ample for approval under the Companies Act.

Furthermore, the opportunity to lobby the other shareholders would almost certainly have been useless, because they were resolved to sell to Kaplan, and had quite likely signed some sort of binding pre-contract already. So the monetary loss suffered is again nil.

Regardless the shareholders agreement would almost certainly have said something about the process for changing the company statutes.

But at the same time the SHAG should also have made some mention of provisions and the process for terminating the agreement itself. If it didn't that would be a serious deficiency, because there must always be some way of terminating agreements, even if they don't say so specifically. And the 78.9% of the votes the sellers could muster collectively is enough to do anything in Company Law.

So the net effect of having done everything strictly by the book would merely have been to delay events by a few weeks. And the only real loss the Trust suffered was by being excluded them the sale process itself. Which is actionable as Unfair Prejudice. [Post edited 16 Sep 2018 18:51]

|

As an aside you mentioned you thought there could be a pre binding contract - do you think that would have included changing the articles as well?

Surely when you look at the detail of the new articles ‘in favour of a new majority shareholder’ - they must have been changed on request of Kaplan and Levein.

Given they were changed just before the sale - Kaplan and Levein must have required the Selling shareholders to do this just before the sale - as a condition of the sale.

Why didn’t Kaplan and Levein change the articles post the sale? They would then have more than 75% voting rights - so do it then? Why get the selling shareholders to do it, just before the sale?

Please don’t say some sort of tidying up exercise. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 07:11 - Sep 17 with 1204 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 23:57 - Sep 16 by Nookiejack |

As an aside you mentioned you thought there could be a pre binding contract - do you think that would have included changing the articles as well?

Surely when you look at the detail of the new articles ‘in favour of a new majority shareholder’ - they must have been changed on request of Kaplan and Levein.

Given they were changed just before the sale - Kaplan and Levein must have required the Selling shareholders to do this just before the sale - as a condition of the sale.

Why didn’t Kaplan and Levein change the articles post the sale? They would then have more than 75% voting rights - so do it then? Why get the selling shareholders to do it, just before the sale?

Please don’t say some sort of tidying up exercise. |

So they would all be in the same boat; sink or swim together.

Or have fully aligned interests, in corporate speak. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 09:24 - Sep 17 with 1134 views | Nookiejack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 07:11 - Sep 17 by Shaky |

So they would all be in the same boat; sink or swim together.

Or have fully aligned interests, in corporate speak. |

So by the new articles being changes before the sale the selling shareholders and Yanks are aligned - but if the Yanks change the articles by themselves after the sale - then they are not aligned and selling shareholders can argue that Yanks did it all by themselves?

If you are right does that evidence collusion between the Yanks and Selling Shareholders to leave the Truat in a minority position with no liquidity for their shares - creating a monetary loss of minimum £21m for the Trust?

At the same time the Selling Shareholders receive more for their shares - given they have sold the control premium to the Yanks.

It really smacks of unfair prejucide in respect of one shareholder ie The Trust. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:03 - Sep 17 with 1102 views | chad |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 23:06 - Sep 16 by QJumpingJack |

The Trust will win in court as Levien has admitted at a fans forum (April 2017) that they were asked to keep the Trust out of the talks. It is on record. |

I think more than just asked, according to Jason in that recorded meeting (in addition to his stuttering and contradictory responses in relation to the shareholder agreement) they were DIRECTED what processes to follow by the selling shareholders.

QUESTION - Why you colluded with the sellers to keep the Trust out of it, and why you went ahead with the sale that was against the Shareholders Agreement and hadn’t met with the requirements — the LEGAL requirements of the Shareholder Agreement.

Now you talk about heart and honesty, how can we believe that when you excluded the people who would be your main shareholders alongside you? We can’t believe that and you’ve got a big job making us believe that.

After some stuttering / superficial comments — understand your hurt great community great opportunity etc….

JASON - The majority of shares were held by shareholders other than the Trust and there was a chairman and er we engaged with the shareholders of the er club who owned almost 80% of the club and (pause) we went through the processes they thought they they directed us.

Completion of the sale was delayed at the end and would love to know exactly what was being said and done in that period. Possibly caused by the concerns that were obviously going on re the shareholder agreement.

In my personal opinion it is not for anyone to assume if the Trust could or could not raise the money to buy the shares of a single shareholder to raise their holding over 25% and so deny the new majority owners the magic 75% voting rights they obviously demanded to make the sale viable to them.

We have achieved extraordinary things in the past and there are many vehicles to raise the few million it would have taken to achieve this. It would have also given us the opportunity to examine the deal more fully.

Remember it was a group deal but each shareholders sale was an individual transaction based on an individual personal contractual responsibility to give the other shareholders right of first refusal.

If the Trust by exercising their legal rights prevented the other sellers from making massive windfall profits by selling their shares then tough. At least it would be honest protection of our own position and rights and not from individual greed. It would also have prevented owners who have had to fork out tens of millions to line the sellouts pockets being forced to take that money out of the club (who had not received a penny of it) having it stripped from its assets if things continue to go south as they have done most substantially already under the new majority owners virtually absolute power. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:11 - Sep 17 with 1085 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 09:24 - Sep 17 by Nookiejack |

So by the new articles being changes before the sale the selling shareholders and Yanks are aligned - but if the Yanks change the articles by themselves after the sale - then they are not aligned and selling shareholders can argue that Yanks did it all by themselves?

If you are right does that evidence collusion between the Yanks and Selling Shareholders to leave the Truat in a minority position with no liquidity for their shares - creating a monetary loss of minimum £21m for the Trust?

At the same time the Selling Shareholders receive more for their shares - given they have sold the control premium to the Yanks.

It really smacks of unfair prejucide in respect of one shareholder ie The Trust. |

Of course there was collusion between the sellers and Kaplan. A right old stitch-up in fact.

The question is whether that was legal?

Here is the thread where I set out the legal strategy for the Trust's action. I suggest you take a look at that

https://wwww.fansnetwork.co.uk/football/swanseacity/forum/190315/page:4

I also respond to some of your questions in the subsequent discussion, but to summarise first of all there was never any real liquidity in the shares. So nothing to redress there.

Secondly it was not apparent that an actual monetary loss had in fact been suffered, only a potential one.

Which is why the argument I devised was not only legally innovative, but also in the way in which the nature of the prejudice against the minority was framed, so as to make it an actually incurred instead of merely a potential loss. That being an important - albeit in my view incorrect - distinction made in one of the judgements that set out this relatively novel area of the law.

No doubt introduced in response to the fact that otherwise there is ample scope in English law to screw minority shareholders silly. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:21 - Sep 17 with 1075 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:03 - Sep 17 by chad |

I think more than just asked, according to Jason in that recorded meeting (in addition to his stuttering and contradictory responses in relation to the shareholder agreement) they were DIRECTED what processes to follow by the selling shareholders.

QUESTION - Why you colluded with the sellers to keep the Trust out of it, and why you went ahead with the sale that was against the Shareholders Agreement and hadn’t met with the requirements — the LEGAL requirements of the Shareholder Agreement.

Now you talk about heart and honesty, how can we believe that when you excluded the people who would be your main shareholders alongside you? We can’t believe that and you’ve got a big job making us believe that.

After some stuttering / superficial comments — understand your hurt great community great opportunity etc….

JASON - The majority of shares were held by shareholders other than the Trust and there was a chairman and er we engaged with the shareholders of the er club who owned almost 80% of the club and (pause) we went through the processes they thought they they directed us.

Completion of the sale was delayed at the end and would love to know exactly what was being said and done in that period. Possibly caused by the concerns that were obviously going on re the shareholder agreement.

In my personal opinion it is not for anyone to assume if the Trust could or could not raise the money to buy the shares of a single shareholder to raise their holding over 25% and so deny the new majority owners the magic 75% voting rights they obviously demanded to make the sale viable to them.

We have achieved extraordinary things in the past and there are many vehicles to raise the few million it would have taken to achieve this. It would have also given us the opportunity to examine the deal more fully.

Remember it was a group deal but each shareholders sale was an individual transaction based on an individual personal contractual responsibility to give the other shareholders right of first refusal.

If the Trust by exercising their legal rights prevented the other sellers from making massive windfall profits by selling their shares then tough. At least it would be honest protection of our own position and rights and not from individual greed. It would also have prevented owners who have had to fork out tens of millions to line the sellouts pockets being forced to take that money out of the club (who had not received a penny of it) having it stripped from its assets if things continue to go south as they have done most substantially already under the new majority owners virtually absolute power. |

I have quite a bit of experience negotiating around right of first refusal clauses and in my view it is extremely unlikely it would have been drafted in such a way as to allow an existing shareholder to buy anything less that the full stake being sold by another would be seller.

Because allowing bite-sized chunks to be bought up creates far too much potential for mischief against the would-be seller.

In fact I would go so far as to say that were that possible according to the shareholders' agreement it would summarily be struck down in a court of law.

It is all or nothing |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:28 - Sep 17 with 1054 views | Nookiejack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:11 - Sep 17 by Shaky |

Of course there was collusion between the sellers and Kaplan. A right old stitch-up in fact.

The question is whether that was legal?

Here is the thread where I set out the legal strategy for the Trust's action. I suggest you take a look at that

https://wwww.fansnetwork.co.uk/football/swanseacity/forum/190315/page:4

I also respond to some of your questions in the subsequent discussion, but to summarise first of all there was never any real liquidity in the shares. So nothing to redress there.

Secondly it was not apparent that an actual monetary loss had in fact been suffered, only a potential one.

Which is why the argument I devised was not only legally innovative, but also in the way in which the nature of the prejudice against the minority was framed, so as to make it an actually incurred instead of merely a potential loss. That being an important - albeit in my view incorrect - distinction made in one of the judgements that set out this relatively novel area of the law.

No doubt introduced in response to the fact that otherwise there is ample scope in English law to screw minority shareholders silly. |

I can’t agree with your liquidity point. Yanks v1.0 made an offer for tomorrow thw Trust’s shares so there was liquidity for the Trust’s shares.

In contrast now - the new articles result in there being currently no liquidity for the Trust’s shares.

The majority shareholder in the future, simply sells the shares to a new buyer without having to include any other shareholders and without having to offer the shares to the other shareholders first.

The new buyer will do the same and so on.

In contrast, If a minority shareholder (ie the Trust) wants to sell its shares - it has to offer them to majority shareholder first.

What new buyer would ever want to buy the Trust’s shares in these circumstances?

You wouldn’t have a Yanks v1.0 making an offer for the Trust’s shares in future. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:33 - Sep 17 with 1045 views | chad |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:21 - Sep 17 by Shaky |

I have quite a bit of experience negotiating around right of first refusal clauses and in my view it is extremely unlikely it would have been drafted in such a way as to allow an existing shareholder to buy anything less that the full stake being sold by another would be seller.

Because allowing bite-sized chunks to be bought up creates far too much potential for mischief against the would-be seller.

In fact I would go so far as to say that were that possible according to the shareholders' agreement it would summarily be struck down in a court of law.

It is all or nothing |

I am sure what you say is correct Shaky

However what I posted is not at odds with that and it is particularly why I said ....

Remember it was a group deal but each shareholders sale was an individual transaction based on an individual personal contractual responsibility to give the other shareholders right of first refusal.

The full stake being sold by some of the would be sellers would be almost precisely what we needed to get to 25%

All from one (or if need be 2) of the individual sellers. Nothing from the rest |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:37 - Sep 17 with 1040 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:28 - Sep 17 by Nookiejack |

I can’t agree with your liquidity point. Yanks v1.0 made an offer for tomorrow thw Trust’s shares so there was liquidity for the Trust’s shares.

In contrast now - the new articles result in there being currently no liquidity for the Trust’s shares.

The majority shareholder in the future, simply sells the shares to a new buyer without having to include any other shareholders and without having to offer the shares to the other shareholders first.

The new buyer will do the same and so on.

In contrast, If a minority shareholder (ie the Trust) wants to sell its shares - it has to offer them to majority shareholder first.

What new buyer would ever want to buy the Trust’s shares in these circumstances?

You wouldn’t have a Yanks v1.0 making an offer for the Trust’s shares in future. |

Offer schmozzer.

Prior to the sale of the controlling stake to Kaplan there was 1 narrow liquidity event in the shares of the club in its 13 year history; the repurchase of Mel Nurse's shares.

By the club, on the basis of a special resolution of shareholders.

It wasn't even an open market transaction between a willing third party buyer and a seller.

It is the norm there is no liquidity in the shares of unlisted private companies, and the courts really have no business creating that in the absence of illegality, such as a successful unfair prejudice action. [Post edited 17 Sep 2018 10:44]

|  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:43 - Sep 17 with 1032 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:33 - Sep 17 by chad |

I am sure what you say is correct Shaky

However what I posted is not at odds with that and it is particularly why I said ....

Remember it was a group deal but each shareholders sale was an individual transaction based on an individual personal contractual responsibility to give the other shareholders right of first refusal.

The full stake being sold by some of the would be sellers would be almost precisely what we needed to get to 25%

All from one (or if need be 2) of the individual sellers. Nothing from the rest |

The smallest stake was 5.3% held by Dineen and Van Zwenden each.

At the £110 million valuation that would be £5.8 million to buy.

Could the Trust have raised that? Possibly, but these clauses invariably impose a time limit, perhaps 3 or 4 weeks at most, and I don't see any way that would have been possible in such a timeframe. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:57 - Sep 17 with 1002 views | JACKMANANDBOY |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:43 - Sep 17 by Shaky |

The smallest stake was 5.3% held by Dineen and Van Zwenden each.

At the £110 million valuation that would be £5.8 million to buy.

Could the Trust have raised that? Possibly, but these clauses invariably impose a time limit, perhaps 3 or 4 weeks at most, and I don't see any way that would have been possible in such a timeframe. |

If it was possible or not is immaterial, the Trust should have been included. The fact they were not is clear prejudice in two senses of the word. [Post edited 17 Sep 2018 10:59]

|  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:58 - Sep 17 with 1000 views | chad |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:43 - Sep 17 by Shaky |

The smallest stake was 5.3% held by Dineen and Van Zwenden each.

At the £110 million valuation that would be £5.8 million to buy.

Could the Trust have raised that? Possibly, but these clauses invariably impose a time limit, perhaps 3 or 4 weeks at most, and I don't see any way that would have been possible in such a timeframe. |

Excellent Bingo, either of those would be fine, no prejudice here.

So back to my original point

In my personal opinion it is not for anyone to assume if the Trust could or could not raise the money to buy the shares of a single shareholder to raise their holding over 25% and so deny the new majority owners the magic 75% voting rights they obviously demanded to make the sale viable to them.

It is amazing what can and has been achieved and each individual shareholder had a legal contractual obligation to offer right of first refusal to the other shareholders.

Each sale an individual transaction with individual personal liability.

They and the buyers (who bought in knowledge of this agreement) might do well to mull that over. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:06 - Sep 17 with 976 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:57 - Sep 17 by JACKMANANDBOY |

If it was possible or not is immaterial, the Trust should have been included. The fact they were not is clear prejudice in two senses of the word. [Post edited 17 Sep 2018 10:59]

|

No it is not.

Anyway this is pointless. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:14 - Sep 17 with 958 views | Shaky |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:06 - Sep 17 by Shaky |

No it is not.

Anyway this is pointless. |

And let me just add for the record, in my view the direction this thread is taking of opening old wounds and whipping up resentment towards the other shareholders is not only pointless but also counter-productive. As i alluded to in my initial post.

Because I believe for the long term good of the club, current conditions are the most favourable I have seen for striking a deal with Kaplan that recapitalises the club, while sharing the pain and the potential gain.

However, going over past grievances again and again is most certainly not conducive to that end. |  |

|  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:16 - Sep 17 with 952 views | Nookiejack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 10:37 - Sep 17 by Shaky |

Offer schmozzer.

Prior to the sale of the controlling stake to Kaplan there was 1 narrow liquidity event in the shares of the club in its 13 year history; the repurchase of Mel Nurse's shares.

By the club, on the basis of a special resolution of shareholders.

It wasn't even an open market transaction between a willing third party buyer and a seller.

It is the norm there is no liquidity in the shares of unlisted private companies, and the courts really have no business creating that in the absence of illegality, such as a successful unfair prejudice action. [Post edited 17 Sep 2018 10:44]

|

Private companies have obviously less liquidity than public companies, where their shares are traded by the micro second.

However it is untrue to say there is no liquidity at all for a private company’s shares - which is the current case in respect of Trust’s shares under the new articles.

The Private Equity model is normally to buy a company and hold on average for a five year time horizon - then sell. So the shares of a private companies held by a private equity fund - will not be traded for at least 5 years. There is still liquidity for these shares - as another private equity fund or trade buyer could make an offer for them at any time.

Many private companies will have a strategy - to grow over a number of years - then look for an exit - hence no sale of shares for a number of years . However when they decide to sell there might be lots of potential buyers, especially if it is a good company. Hence lack of record of transactions in shares over a number of years, in this example, is due to shareholders strategy of long term hold - which results in no shares being traded - rather than lack of buyers.

Under new artilcles there will be no future buyers for the Trust’s shares.

I also understood from all the past threads that Yanks v1.0 made an offer for the Trust’s shares- that would demonstrate liquidity for the Trust’s shares. There is no liquidity for the Trust’s shares now. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:27 - Sep 17 with 936 views | Nookiejack |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:14 - Sep 17 by Shaky |

And let me just add for the record, in my view the direction this thread is taking of opening old wounds and whipping up resentment towards the other shareholders is not only pointless but also counter-productive. As i alluded to in my initial post.

Because I believe for the long term good of the club, current conditions are the most favourable I have seen for striking a deal with Kaplan that recapitalises the club, while sharing the pain and the potential gain.

However, going over past grievances again and again is most certainly not conducive to that end. |

I agree when you take a look at these unfair prejudice cases - the courts seem to decide on the basis of what is ‘fair and equitable’ to all parties.

That’s why I think they will eventually decide that the selling shareholders should buy the Trust’s shares out on same terms they received - as if Trust was included in the sale all along.

That’s why I think the selling shareholders should make that offer now - rather than waste all the legal expense of going to court.

Selling shareholders that received say £5m will then net of settlement receive £4m and those that received £10m will then receive £8m - how much money to people really need?

Heal the wounds. |  | |  |

| Answers questions about the Trust's Legal Claims and Request for Mediation on 11:33 - Sep 17 with 929 views | Shaky |

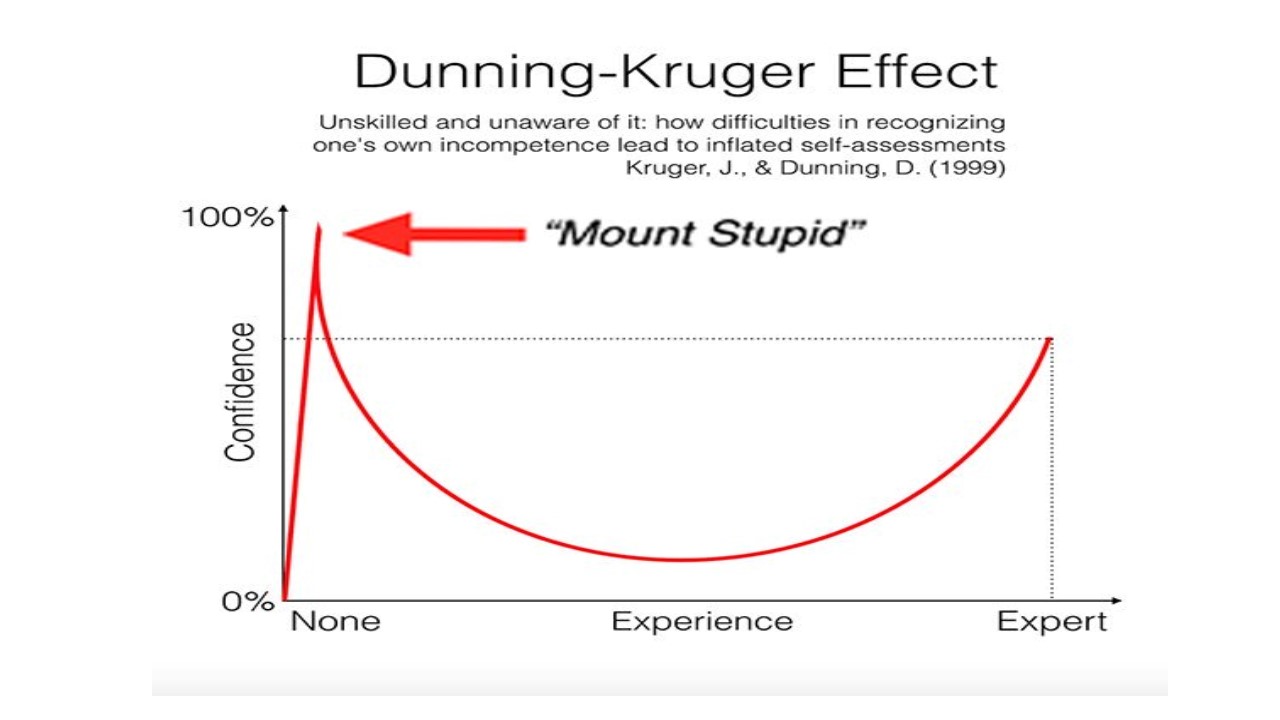

This is not directed at anyone in particular, but is merely an item provided for contemplation and reflection:

|  |

|  |

| |